are nursing home fees tax deductible in uk

Are nursing home fees tax deductible in uk Wednesday March 9 2022 Edit. There also are a number of other tax reliefs for carers and people with disabilities.

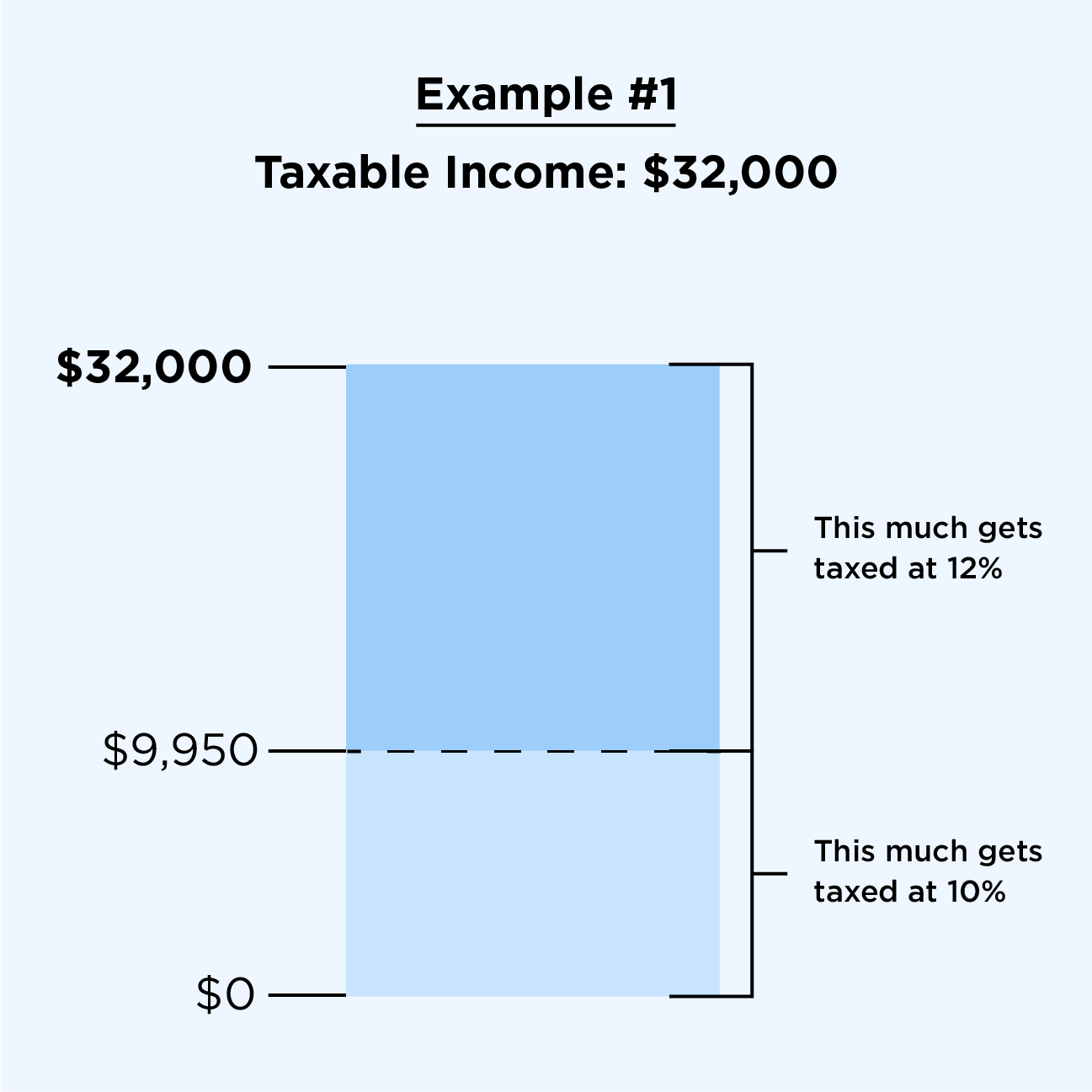

Tax Planning For Beginners 6 Tax Strategies Concepts Nerdwallet

If you pay medical expenses that are not covered by the State or by private health insurance you may claim tax relief on some of those.

. You must pay full fees known as being self-funding. Up to 15 cash back UK Tax. Yes in certain instances nursing home expenses are deductible medical expenses.

Which nursing home costs are tax deductible. Tax relief on nursing home fees. An adjusted gross income AGI of 5 percent is a tax on profit.

Mar 7 2012. Income tax relief is available on fees paid for nursing homes. In Wales it is 17997 and in Northern Ireland it.

Are Care Home Fees Tax Deductible Uk. Research from LaingBuisson showed that average care home fees in the UK range from 27000 to 39000 a year for residential care increasing to 35000 55000 per year if. Ask a UK tax advisor for answers ASAP.

How much of nursing home costs are tax deductible. Local-authority funding may be available but. Between 14250 and 23250.

Unlike healthcare social care is rarely free. If you your spouse or your dependent is in a nursing home primarily for medical care then the. If a single person is forced to go into a care home but because her home is worth 200000 she will receive no support to pay her care home.

You cant claim back fees or subscriptions for. Are privately funded nursing home fees tax. Are nursing home fees tax deductible in uk Wednesday March 9 2022 Edit.

Taxation and Medical Expenses. Most people who need residential care in later life will have to pay some or all of the costs themselves. Home deductible fees home uk.

If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense. For instance if your total qualifying medical expenses are 25000 and your adjusted gross income is 80000. You contribute from income included in the means test such as.

In England as of 11th May 2022 the rate for this is 20919 this is an increase of just over 11 from the. Some 40000 houses are dispossessed each year by local authorities to pay for care fees where the. Connect one-on-one with 0.

You may claim Income Tax IT relief on nursing home expenses paid by you. However a 91-year old has a tax-free personal allowance of 10660 in the coming tax year so without knowing his exact financial. FNC is a fixed amount each week which is paid to the nursing home.

This is how you would calculate your deduction. If the primary reason for entering the nursing home is not to obtain medical care only the. Do Existing Tax Incentives Increase Homeownership Tax.

Watch Are Care Home Costs Tax Deductible Uk Video. As already said it is taxable. You can claim this relief as a deduction from your total income if the nursing home provides 24.

Are care home fees deductible. You claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. People with capital below these amounts can get financial support from their local authority which will pay some or all of the costs.

10 Costs To Include In Your Retirement Budget

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Tax Advantages For Donor Advised Funds Nptrust

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Sales Tax Deduction What It Is How To Take Advantage Bankrate

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

No You Can T Deduct That 11 Tax Deductions That Can Get You In Trouble Inc Com

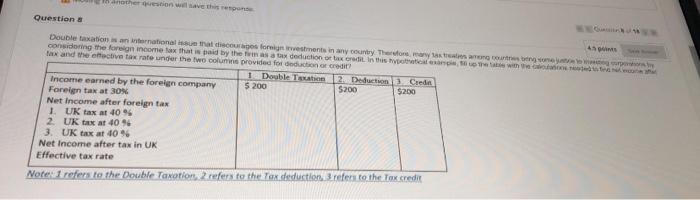

Solved Another Weten We Then Question Double Taxation Chegg Com

How Do Food Delivery Couriers Pay Taxes Get It Back

Overlooked Tax Deductions For Nurses And Healthcare Professionals The Handy Tax Guy

Complete Guide Home Equity Loans And Tax Deductions Bankrate

10 Tax Planning Tips For The End Of The Year Kiplinger

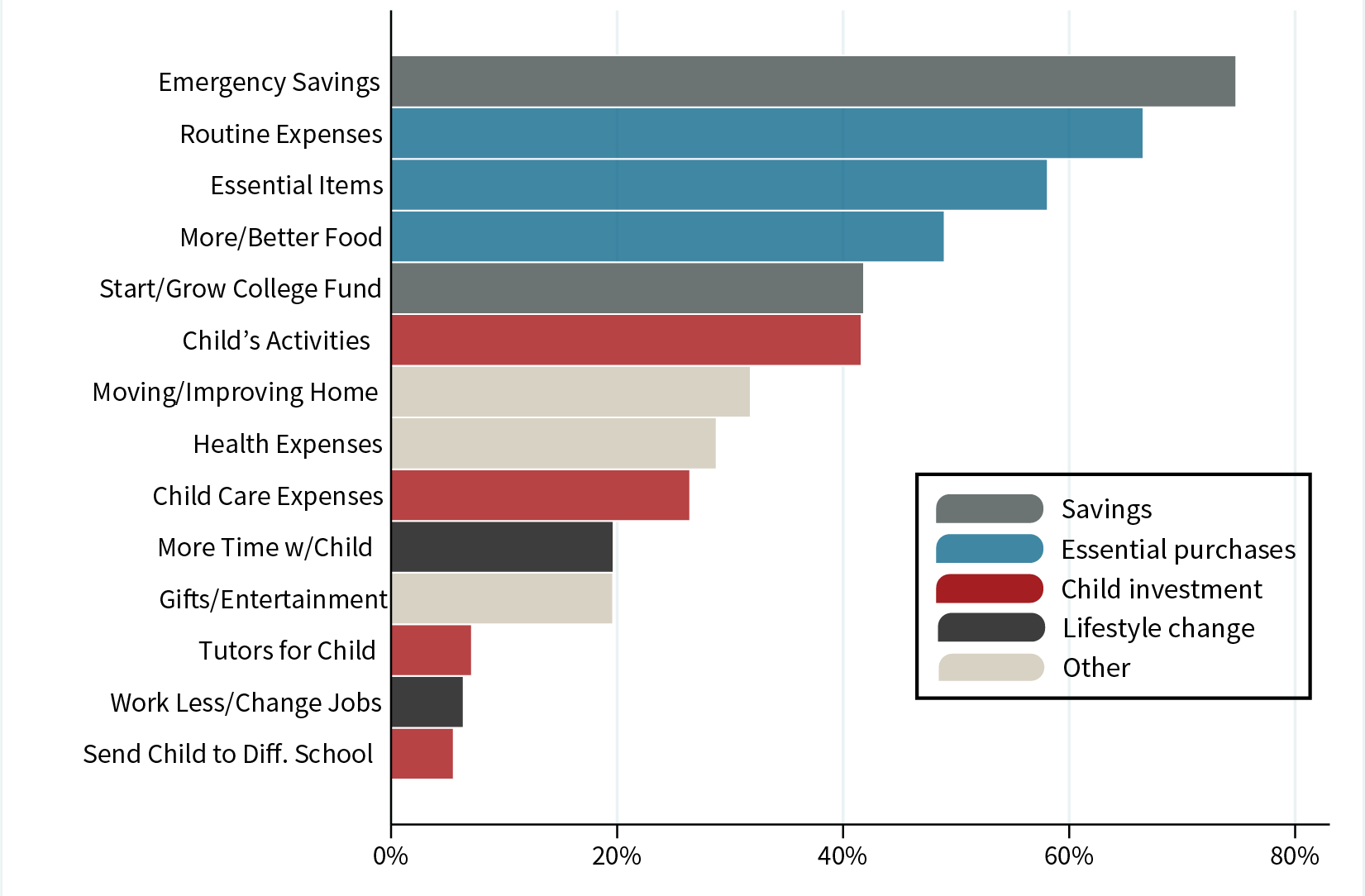

The New Child Tax Credit Does More Than Just Cut Poverty

Finance Tax And The Move To A Nursing Home

Is Elder Care Tax Deductible Spada Care Homes

A Comparison Of The Tax Burden On Labor In The Oecd Tax Foundation